Dar unboxes Rs14.46tr outlay sans new taxes

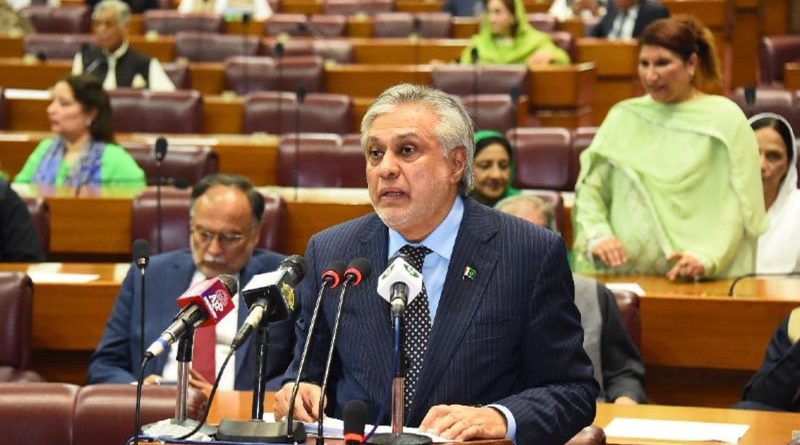

ISLAMABAD: Finance Minister Ishaq Dar Friday unboxed a Rs14.46 trillion budget for the fiscal year 2023-24, introducing “no new taxes” and envisaging an economic growth of 3.5% as the crisis-ridden country looks to persuade the International Monetary Fund (IMF) to release more bailout money.

Pakistan has shared the budget numbers with the IMF, and the finance minister believes there are no further objections the lender could raise — as the country is in line with the programme requirements.

During his budget speech, Dar said that this budget was “not an election budget” and was focusing on the “elements of the real economy”.

The total expenses estimate, he said, was set at Rs 14.46 trillion, out of which Rs 7.3 trillion would be spent on interest payment. The budget deficit was expected to remain 6.54 percent and the primary balance would be a surplus of 0.4 percent to the GDP.

The minister said the tax collection target of the FBR for the next fiscal year had been fixed at Rs 9.2 trillion, including provincial share of Rs 5.276 trillion.

The federal non-tax revenues, he added, would be Rs 2.963 trillion while total income of the Federal Government would be Rs 6.887 billion. Dar said an amount of Rs 950 billion was being allocated for the development projects under the PSDP 2023-24.

Moreover, an additional amount of Rs 200 billion would also be part of the development budget. The country’s defence and civil administration would be provided Rs 1.8 trillion and Rs 714 billion respectively whereas Rs 761 billion had been allocated for the payments of employees pensions.

Dar said the government had estimated an expenditure of Rs 1.074 trillion for the provision of subsidies in electricity, gas and other sectors.

The finance minister said, due to the “prudent decisions of the incumbent government” — majorly the import curbs — the CAD has been reduced by 77% to $4 billion.

Likewise, he said, the trade deficit has been reduced by $21 billion.Hesaid remittances are a crucial part of foreign exchange reserves, representing 90% of the country’s exports.

In a bid to promote remittances through formal channels, the government has proposed the abolishment of 2% final tax on the purchase of immovable property.

For the HEC, the federal government has proposed an allocation of Rs65 billion, while Rs70 billion have been allocated for development expenditure.

Meanwhile, under the Prime Minister Laptop Scheme, the federal government has decided to distribute 100,000 laptops to merit-based deserving students, and the cabinet has proposed to allocate Rs10 billion.

Dar further said that in order to incentivize the construction sector, “the 10% or Rs5 million, whatever amount is less, will be charged on construction enterprise income.”

Those individuals who will construct their own property will be given a 10% tax credit or Rs5 million for the next three years as part of the concessions to the construction sector.

Moreover, he added that the 10% super tax was imposed on 15 businesses and sectors earning up to Rs150 million in the last budget.

He said it had been proposed to increase the minimum wage to Rs32,000 for Islamabad Capital Territories (ICT).

Dar said that the minimum pension is being increased to Rs12,000. He also proposed to increase the Employees’ Old-Age Benefits Institution (EOBI) pension to Rs10,000. Agencies